News & Articles

Published articles, interviews and Bench Walk related news.

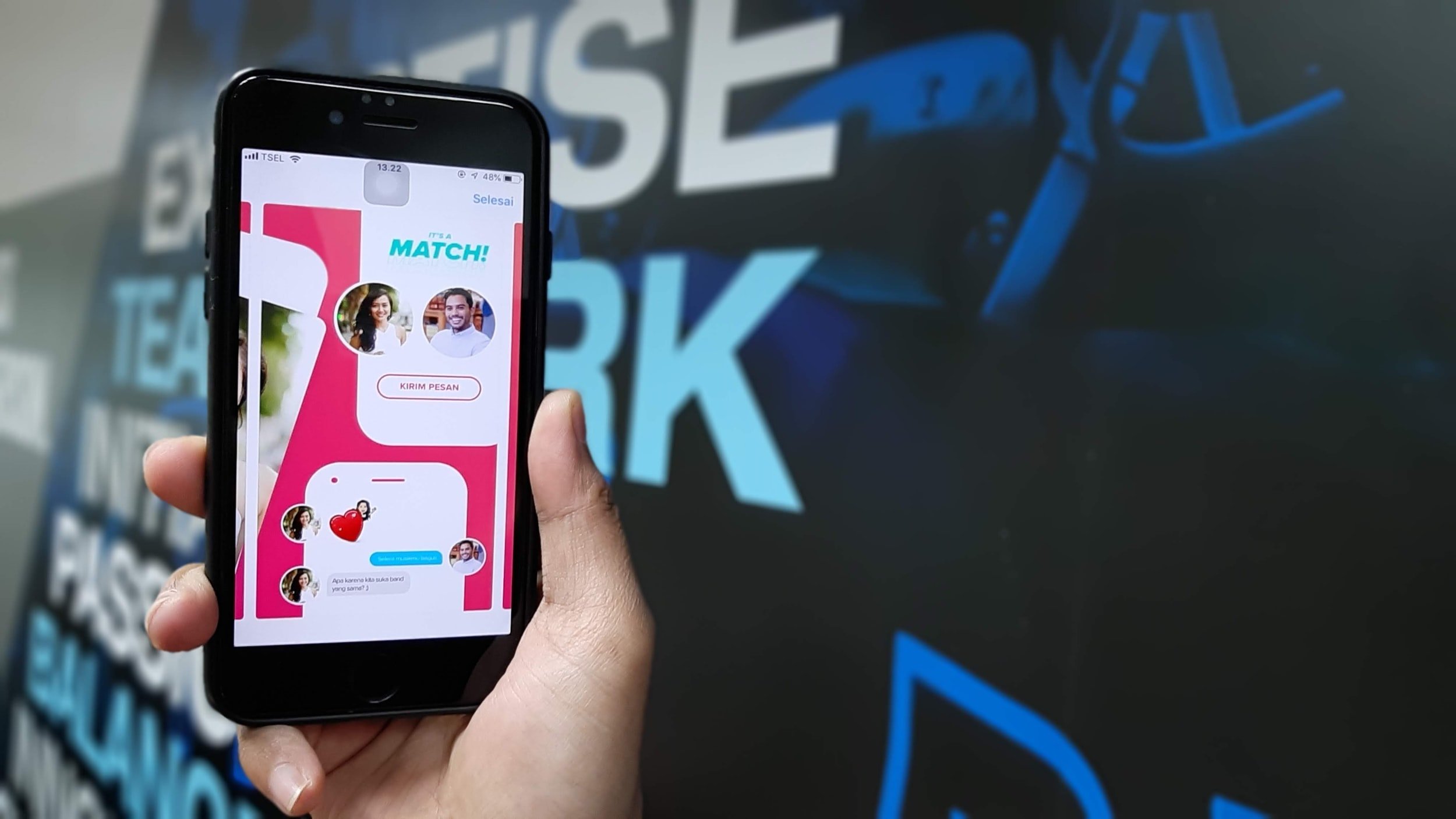

Match Group Settles Lawsuit Over Tinder’s Valuation

Bench Walk Advisors is proud to have financed this claim and to have helped facilitate a great outcome for the plaintiffs. On behalf of everyone at Bench Walk, our warmest congratulations to all involved.

Bench Walk’s UK team graces the cover of Acquisition International

Massive congratulations to our UK Team for winning Acquisition International Magazine's ‘Most Innovative Legal Capital Solutions Provider’ award.

Funder mentalists: how much does a legal megabrain cost?

In my prior blogs I examined “implied probability of loss” as a way of analysing the risk and price of transactions in the litigation funding market.

Let’s take for example (and with all the usual caveats about being reductive) a funder that determines that a case has, say, a 2/3 chance of winning and generating for both the claimant and the funder lots of money, and a 1/3 chance of losing with an attendant destruction of the funder’s entire investment. When pricing this case that funder must charge, on a win, $1.5 for every $1 invested just to break even. This is because the funder has a 1 in 3 chance of losing 100% and a 2/3 chance of winning 150%, which yields, on average, 100% (that is, a mere return of the funder’s investment).

Funding Nemo: do funders fund too few cases?

Litigation funding has typically focused on claimant side investment. Defence funding feels less valuable because it does not so obviously unlock an asset. In addition, the cash benefit of having a funder pay defence legal costs will often be dwarfed by the potential cash payout by the defendant on a loss. And finally, a defendant worth suing is usually not cash constrained in the same way as many claimants who seek funding. But as the funding market has matured, some funders, defence lawyers and their clients have begun to express interest in defence funding.

Funders keepers: is litigation funding too expensive? (Part 2)

Litigation funding has typically focused on claimant side investment. Defence funding feels less valuable because it does not so obviously unlock an asset. In addition, the cash benefit of having a funder pay defence legal costs will often be dwarfed by the potential cash payout by the defendant on a loss. And finally, a defendant worth suing is usually not cash constrained in the same way as many claimants who seek funding. But as the funding market has matured, some funders, defence lawyers and their clients have begun to express interest in defence funding.

Funders keepers: is litigation funding too expensive? (Part 1)

Litigation funding has typically focused on claimant side investment. Defence funding feels less valuable because it does not so obviously unlock an asset. In addition, the cash benefit of having a funder pay defence legal costs will often be dwarfed by the potential cash payout by the defendant on a loss. And finally, a defendant worth suing is usually not cash constrained in the same way as many claimants who seek funding. But as the funding market has matured, some funders, defence lawyers and their clients have begun to express interest in defence funding.

Litigation funding: no longer sitting on defence

Litigation funding has typically focused on claimant side investment. Defence funding feels less valuable because it does not so obviously unlock an asset. In addition, the cash benefit of having a funder pay defence legal costs will often be dwarfed by the potential cash payout by the defendant on a loss. And finally, a defendant worth suing is usually not cash constrained in the same way as many claimants who seek funding. But as the funding market has matured, some funders, defence lawyers and their clients have begun to express interest in defence funding.